Introduction: Introduction:

Life begins afresh when you become a parent. It’s a joy you never felt and a feeling you never experienced. When your child takes baby steps towards you, you wonder what else bliss could be?

Amidst all this divine happiness, there’s a new sense of responsibility that fills your heart. Like you may not really believe that life’s a rose bed or a tender cushion, but you certainly want it to be for your lovely children. At SBI Life, we understand and we provide you with a flexible and all-encompassing solution through our SBI Life Insurance Smart Scholar Plan.Choose the one that suits you and your child’s needs best. Our specially crafted Smart Scholar Plan is as accommodating as you are to your child. |

| Key Features: |

| • |

Secure your child’s future by gaining from the financial markets and much more. |

| • |

Dual protection for your family, in case you are not around –

| • |

Payment of base Sum Assured and |

| • |

Inbuilt Premium Payor Waiver benefit to ensure continuance of your benefits. |

|

| • |

Accident Benefit which includes Accidental Death benefit and Accidental Total and Permanent Disability (Accidental TPD) benefit, is an integral part of the plan. |

| • |

Free allocation of units by way of regular Loyalty Additions, giving periodic boosts to your investments. |

| • |

Enhanced investment opportunity through 9 varied fund options including P/E Managed Fund, Index Fund & Top 300 Fund. |

| • |

Twin benefits of market linked return & insurance benefit. |

| • |

Liquidity through partial withdrawal(s). |

|

|

Product Snapshot :

|

| Age at Entry * |

Child: Min: 0 years |

Max: 17 years |

| Proposer: Min: 18 years |

Max: 57 years |

| Max. Age at Maturity |

65 years |

| Policy Term |

Min: 8 years

Max: 25 years less child’s age at entry

(On Maturity, the age of child should be between 18 to 25 years) |

| Premium Payment Terms (PPT) |

| • |

Single Premium |

| • |

5 to 25 years (subject to the limits of policy term) |

|

| Premium Amounts(x100) |

Minimum:

| PPT |

Frequency |

Minimum(Rs) |

| SP |

Single |

75,000 |

| 5 years to 7 years |

Yearly |

50,000 |

| Half Yearly |

25.000 |

| Quarterly |

12,500 |

| Monthly*** |

4,500 |

| 8 years or more |

Yearly |

24,000 |

| Half Yearly |

16,000 |

| Quarterly |

10,000 |

| Monthly*** |

4,000 |

|

| Sum Assured |

For Single Premium:

| Minimum |

Maximum |

| Across all ages |

Age<45 years |

Age=>45 years |

| 1.25 * SP |

5 * SP |

1.25 * SP |

For other PPTs:

| Minimum |

Maximum |

| Age<45 years |

Age=>45 years |

Across all |

| Higher of: 10 * AP or ½ * T * AP |

7 * AP |

20 * AP |

|

| Partial Withdrawals |

Upto 15% of Fund Value can be withdrawn each year, from 6th year onwards, subject to conditions. 1 free partial withdrawal in a policy year |

| Tax Benefits** |

Under Sec. 80C and Sec. 10(10D) of Income Tax Act,1961 |

|

|

* All the references to age are age as on last birthday.

*** For monthly mode, 3 months premium to be paid in advance and renewal premium payment is allowed only through ECS, Credit card, Direct debit and SI-EFT |

|

Loyalty Additions, by way of free allocation of units:

|

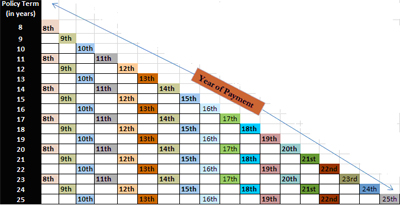

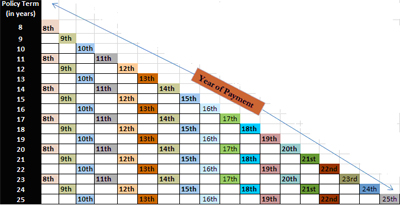

| During the term of the policy loyalty units would be given for in-force policies on completion of specific durations. Loyalty additions depend on term of the policy.

The loyalty addition at relevant policy year end will be equivalent to –1% x [Average fund value over the 1st day of the last 24 policy months]

Loyalty additions are payable at the end of the year(s) as per the chart below: |

|

|

Benefits:

|

| • |

Basic Life Benefit: |

|

• |

In the event of unfortunate death of life assured, a lump sum benefit equal to higher of the Sum Assured or 105% of all premiums paid till date of death will be payable. |

|

• |

If on the date of death, the sum assured is less than 105% of all premiums paid, the amount in excess of the sum assured will be paid from your fund by disinvestment of units.

|

|

• |

In the event of death of child no sum assured is payable. Life assured will inform the Company regarding the event. In such case he/she can either continue the policy or terminate the contract. In case of termination of contract, the fund value (without any surrender charges), will be payable.

|

|

• |

If both the life assured and the child die during the term of the policy the policy will be automatically terminated and all due benefits will be paid along with the fund value..

|

| • |

Maturity Benefit: |

|

• |

On completion of the policy term, maturity benefit i.e. the fund value shall be paid to beneficiary in a lump sum or as per settlement option, if chosen.

|

The beneficiary will be:

The policyholder if he/she survives. OR

Child, in case of death of the life assured during the policy term.

•Tax Benefits •

Tax deduction under Section 80C is available. However in case the premium paid during the financial year, exceeds 10% of the sum assured, the benefit will be limited up to 10% of the sum assured. .

•Tax exemption under Section 10(10D) is available, subject to the premium not exceeding 10% of the sum assured in any of the years during the term of the policy. •

Tax benefits, are as per the Income Tax laws & are subject to change from time to time. Please consult your tax advisor for details.

Note:

Index Fund (SFIN : ULIF015070110INDEXULFND111)

Top 300 Fund (SFIN : ULIF016070110TOP300-FND111)

P/E Managed Fund (SFIN : ULIF021080910P/EMNGDFND111)

For more details on risk factors, terms and conditions please read the sales brochure carefully before concluding a sale. Insurance is a subject matter of solicitation.

Brochure

You may view or download the official brochure of this plan from here.

Benefit Illustration

You may check the customized benefit illustration of this plan as per your premium, age, S.A. etc. from here.

Mortality Rates

You may check the mortality rates for this plan from here.